High-Ratio Mortgages: Achieve Homeownership with a Smaller Down Payment

As a professional mortgage agent in Ontario, I can help you understand your options, walk you through the application process, and find the best high-ratio mortgage solution for your needs.

High-Ratio Mortgages in Ontario: Achieve Homeownership with a Smaller Down Payment

In Ontario’s competitive housing market, coming up with a large down payment can be one of the biggest hurdles for potential homeowners. Fortunately, high-ratio mortgages offer a viable solution for those with limited savings. With a down payment as low as 5%, high-ratio mortgages make it easier for first-time homebuyers and others to enter the market.

What is a High Ratio Mortgage?

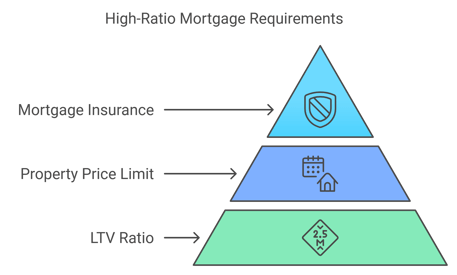

A high ratio mortgage is a type of mortgage loan where the down payment is less than 20% of the home's purchase price. This means that the borrower is borrowing more than 80% of the home’s value. In Ontario, any mortgage with a down payment lower than 20% requires mortgage default insurance, which helps protect the lender in case the borrower defaults on the loan.

High ratio mortgages are a popular choice for many buyers, especially first-time homebuyers or those looking to get into the real estate market with a smaller upfront investment.

How Does a High Ratio Mortgage Work?

In Ontario, high-ratio mortgages follow specific provincial and federal regulations. To qualify, the home you are purchasing must be owner-occupied and the property value must be under $1 million.

- Down Payment Requirements: You’ll need a down payment of at least 5% for homes priced under $500,000. For homes priced between $500,000 and $999,999, the minimum down payment is 5% for the first $500,000 and 10% for the remaining amount.

- Mortgage Default Insurance: Since high-ratio mortgages are considered higher risk, the mortgage lender will require you to purchase mortgage default insurance from providers like CMHC (Canada Mortgage and Housing Corporation), Genworth, or Canada Guaranty. This insurance protects the lender in the event of loan default but also allows you to secure a mortgage with a lower down payment.

Benefits of High Ratio Mortgages

- Lower Down Payment: One of the biggest advantages is the ability to buy a home with a smaller down payment, typically as low as 5%.

- Competitive Interest Rates: Despite the smaller down payment, you can still secure competitive interest rates, as long as you meet the qualifications.

- Faster Path to Homeownership: High-ratio mortgages make it easier to get into the housing market sooner, which is ideal for first-time buyers or those who don't have the full 20% saved.

- Flexibility: With a variety of mortgage terms and insurance options, you can customize your high-ratio mortgage to fit your financial situation.

Eligibility Criteria for High Ratio Mortgages in Ontario

To qualify for a high-ratio mortgage in Ontario, lenders will assess several key factors:

- Credit Score: Most lenders require a credit score of 600 or higher, although this can vary. A higher credit score often results in better mortgage terms and interest rates.

- Debt Service Ratios: Lenders will evaluate your Gross Debt Service (GDS) ratio and Total Debt Service (TDS) ratio to ensure you can afford the monthly payments.

- Income Verification: You’ll need to provide documentation of your income to prove you can meet mortgage payments.

Costs Associated with High Ratio Mortgages

While the low down payment is a major benefit, it’s important to be aware of the costs associated with high-ratio mortgages, including:

- Mortgage Default Insurance Premiums: These premiums are based on the size of your down payment and the mortgage amount. Premiums range from 0.6% to 4.0% of the mortgage amount, and they are typically added to your loan balance.

- Closing Costs: In addition to the down payment, there are other closing costs, such as land transfer taxes and legal fees, which you should budget for.

How to Apply for a High Ratio Mortgage in Ontario

Applying for a high-ratio mortgage is similar to applying for a traditional mortgage, but there are a few extra steps due to the requirement for mortgage insurance:

- Pre-Approval: Begin by getting pre-approved for a mortgage. This will give you an idea of how much you can borrow and what your monthly payments will be.

- Submit Documentation: Provide proof of income, credit history, and other financial documents to the lender for underwriting.

- Mortgage Default Insurance: If your down payment is below 20%, you’ll need to obtain mortgage default insurance. The lender will usually arrange this for you.

- Close the Deal: Once approved, you’ll sign your mortgage agreement and finalize the purchase of your home.

Important Ontario Regulations for High-Ratio Mortgages

- Maximum Loan-to-Value (LTV) Ratio: Ontario follows federal regulations, which limit the maximum loan-to-value ratio for high-ratio mortgages to 95%. This means you must have at least a 5% down payment on your home.

- Property Price Limits: Homes with a price above $1 million cannot qualify for high-ratio mortgages, according to current regulations.

- Mortgage Insurance Requirement: As mentioned earlier, high-ratio mortgages require mortgage default insurance, which is governed by federal agencies like CMHC.