Fixed vs Variable Rate Mortgages

Compare fixed-rate and variable-rate mortgages to find the best fit for your needs. Explore stable payments or potential savings with expert guidance today!

When choosing a mortgage, understanding the difference between fixed-rate mortgages and variable-rate mortgages is essential to make the best decision for your financial future. Both options offer unique advantages, and selecting the right one depends on your goals, budget, and risk tolerance.

What is a Fixed-Rate Mortgage?

A fixed-rate mortgage offers an interest rate that stays the same for the duration of the loan term. This means your monthly payments for principal and interest will stay the same, making it a great choice for homeowners who value stability and predictability.

Key Benefits of Fixed-Rate Mortgages:

- Predictable Payments: Budget with confidence knowing your payments won't change.

- Long-Term Stability: Lock in a low rate for the duration of your term.

- Peace of Mind: Protect yourself from potential interest rate increases.

Fixed-rate mortgages are ideal for individuals planning to stay in their home long-term or who prefer to avoid market fluctuations.

What is a Variable-Rate Mortgage?

A variable-rate mortgage (also known as an adjustable-rate mortgage) has an interest rate that can fluctuate over time, depending on market conditions. Typically, these mortgages offer a lower initial rate than fixed-rate options, which can lead to savings in the short term.

Key Benefits of Variable-Rate Mortgages:

- Lower Initial Rates: Enjoy lower payments during the introductory period.

- Potential Savings: If interest rates decrease, your payments may decrease too.

- Flexibility: Great for homeowners who may sell or refinance before rates adjust significantly.

Variable-rate mortgages are a good option for those who can handle some risk or expect interest rates to stay stable or decline.

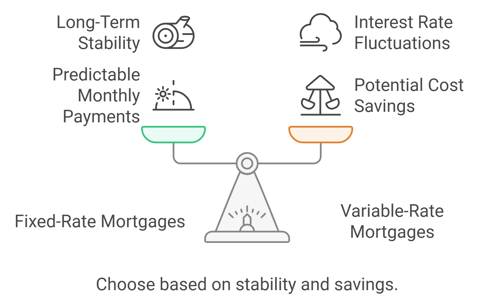

Fixed vs. Variable: What Should You Choose?

Deciding between a fixed-rate and variable-rate mortgage hinges on your financial circumstances and personal preferences. Consider the following:

Fixed-Rate Mortgage: Ideal for individuals who prioritize stability, long-term planning, or safeguarding against increasing rates.

Variable-Rate Mortgage: Suitable for those who are at ease with market changes or seeking short-term financial benefits.

Expert Advice to Help You Decide

Deciding between a fixed or variable rate doesn’t have to be overwhelming. As an experienced mortgage agent like myself, I can help you compare the pros and cons, calculate potential costs, and find the best mortgage product for your unique needs.

Contact me today to explore your options and secure the right mortgage for your future!

check out my latest video on breaking down rate options